Independent high street shops could bear the brunt of Rachel Reeves’ tax raid due to the increase in employers’ National Insurance Contributions (NICs), according to a new analysis shared with City AM.

The study, commissioned by small business platform Enterprise Nation, examined the impact of the 1.2 per cent rise in employers’ NICs, taking into account the increase in employment allowance, across four different "typical" business scenarios Tyler said, as reported by City AM.

It found that a busy high street cafe with up to 26 staff members on a "lower paid rate" would see a 100 per cent surge in NICs. This is in stark contrast to a small e-commerce business with fewer, but higher-paid employees, which will face an increase of around 17 per cent.

Emma Jones, founder and CEO of Enterprise Nation, said: "The calculations we’ve used here illustrate the complicated range of challenges that small businesses are facing right now."

She added: "Entrepreneurs are always resilient – but they will need help to navigate the road ahead and start dealing with the implications in good time for the changes in April 2025. We must not allow this to threaten vulnerable businesses like independent high street shops and cafes."

To adapt to these changes, Jones emphasized the importance of small businesses embracing technological advancements to improve productivity, competitiveness, and innovation. Entrepreneur Oli Tyler, the founder of plant-gifting firm Shroot, expressed confidence in managing the tax hikes for his business but voiced concerns for those facing more significant challenges.

Recent

See All2025-05-10

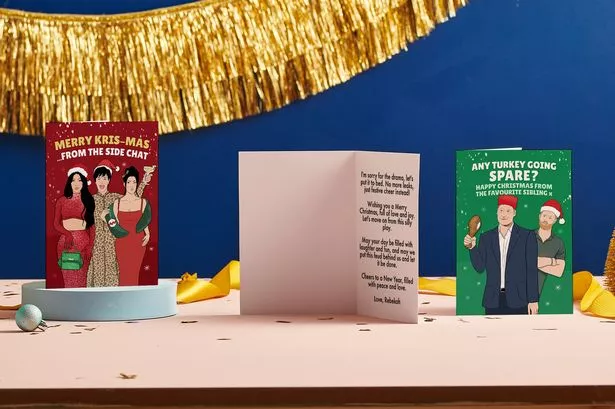

Moonpig shares tumble as card maker swings to £33m loss in first half of financial year

2025-05-10

Black Friday's late timing blamed for 'disappointing' fall in retail sales

2025-05-10

Sainsbury's Employees to Receive Salary Boost Following Successful Holiday Season and Market Share Gain

2025-05-10

Debenhams makes first profit since Boohoo rescue despite sales halving

2025-05-10

Warpaint London set to acquire Brand Architekts in a £13.9m deal

2025-05-10

Poundland owner Pepco reports £458.7m loss amid declining UK sales

2025-05-10

British Gas owner Centrica adds £300m to share buyback plan amid nuke boost

2025-05-10

TalkTalk may cut nearly 25% of consumer staff, including roles at Salford HQ

2025-05-10

Industry Professionals Decry Cancellation of Extra Bank Holiday in 2025

2025-05-10

Mike Ashley's Frasers lowers profit guidance after October's Budget

Newsletter

Get life tips delivered directly to your inbox!